Wapouzé

Wapouzé in north-eastern Cameroon was initially explored as an early-stage gold exploration prospect, however, Oriole noted the presence of large quantities of carbonate (predominantly metamorphosed limestone). Potentially, this limestone could be ideal for commercial use in Cameroon’s cement industry.

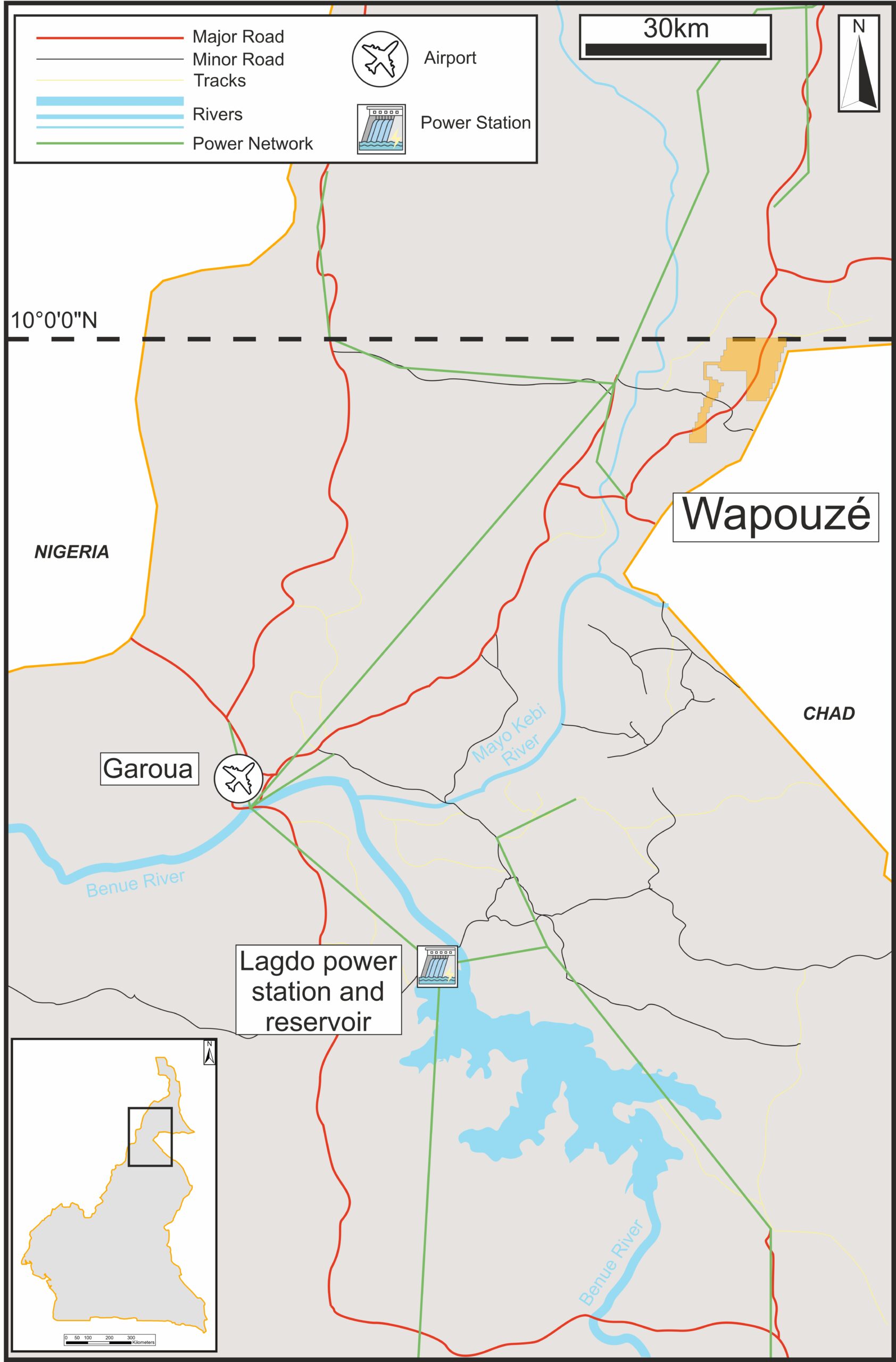

Wapouzé (88 km2) is located 20 km north of Bibemi, in a similar geological setting. Following a review of the historical data in 2022-2023, the Company determined that gold prospectivity at Wapouzé was lower than that at the Group’s nearby Bibemi project. However, it highlighted the potential for cement-quality limestone within the licence area.

Oriole submitted a formal request for a change of substance at the Wapouzé licence area from gold to industrial minerals, and as of February 2025 the licence has been renewed for a further term of two years, with an approved work programme focused on limestone exploration.

Oriole will now look to secure an industry partner that will advance Wapouzé towards resource definition, development and exploitation on an expedited basis. Oriole is ultimately looking to achieve royalty-based income from a commercial scale quarrying operation, likely to be based upon the volume of material extracted, which would provide valuable in-country revenue that could be used for funding some of its exploration in Cameroon.

Limestone potential

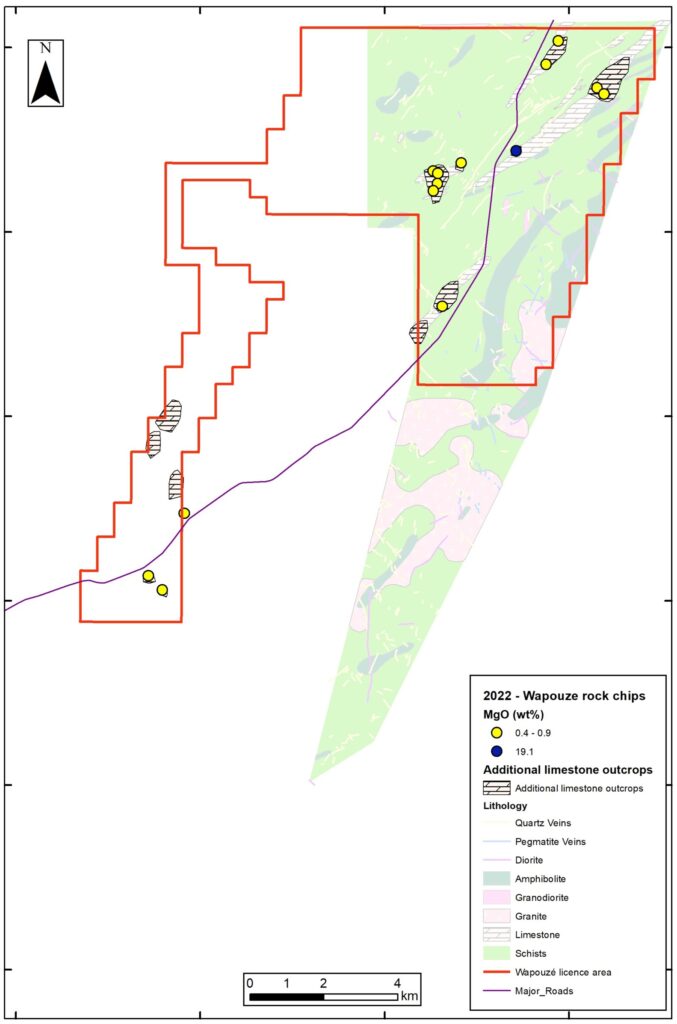

The presence of limestone within the licence area was confirmed during the geological mapping of the north-eastern corner of the licence. Within this area, three significant en-echelon bands of limestone, and a number of smaller beds, outcrop in a northeast-southwest direction. The largest continual unit extends for over an approximate strike length of 7.5km, with widths at surface of up to 500m. Cumulatively, the strike length of limestone units exceeds 20km within the eastern half of the licence.

Detailed geological mapping was focused on the eastern half of the licence area, which delineated a total mapped surface area of limestone standing at approximately 4,420,000m2. It is important to note that limestone units also exist within the western half of the licence area, particularly the southwestern corner, and so the surface area exposure of limestone within the Wapouzé licence overall would be significantly larger than the approximate amount of 4,420,000m2 mapped to date.

In 2022, fourteen rock-chip samples were collected for XRF analysis to assess the suitability of the carbonate for industrial use. Out of the 14 samples collected across Wapouzé, only one sample returned MgO concentrations that indicate dolomitization. The remaining thirteen samples returned low MgO concentrations (0.40 – 0.8 wt%), and high CaO concentrations (54.2 – 55.3 wt%). All samples contained appropriate concentrations of SiO2 ranging from <0.01 wt% to 1.58 wt%. Thirteen of the fourteen samples would therefore be classified as high-grade carbonate material suitable for use in cement production.

| Average CaO (wt%) | Average SiO2 (wt%) | Average MgO (wt%) | |

| Carbonate (n = 13) | 54.6 | 0.66 | 0.66 |

| Partial dolomitisation (n =1) | 32.4 | 1.53 | 19.1 |

Previous Exploration

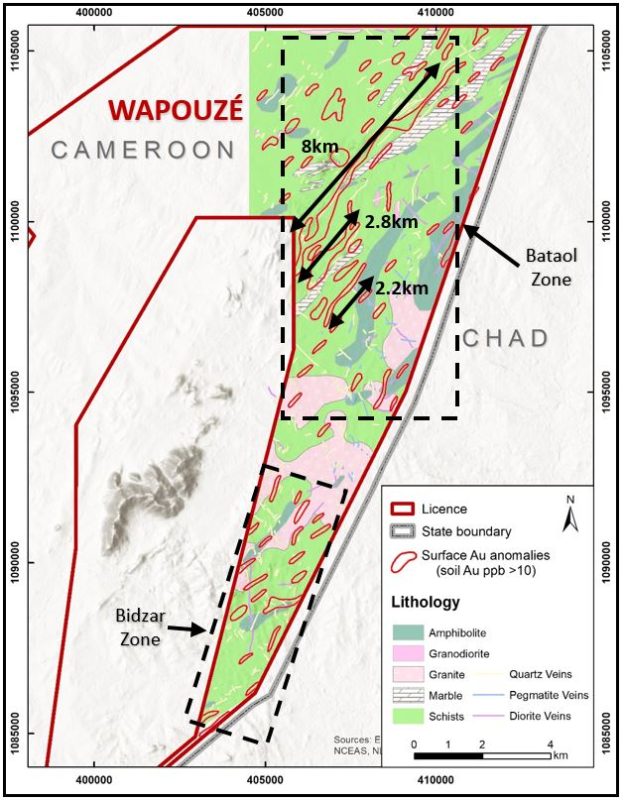

Reservoir Minerals conducted 1.5 samples per km2 stream sediment sampling between 2011 and 2015 and results (with 269 out of 573 samples analysed) included 14 samples >10ppb Au, 6 samples >25ppb Au and 3 samples >50ppb Au. The main anomalous structure follows the same orientation as at Bibemi and additional zones showing signs of mineralisation have been identified for follow-up.

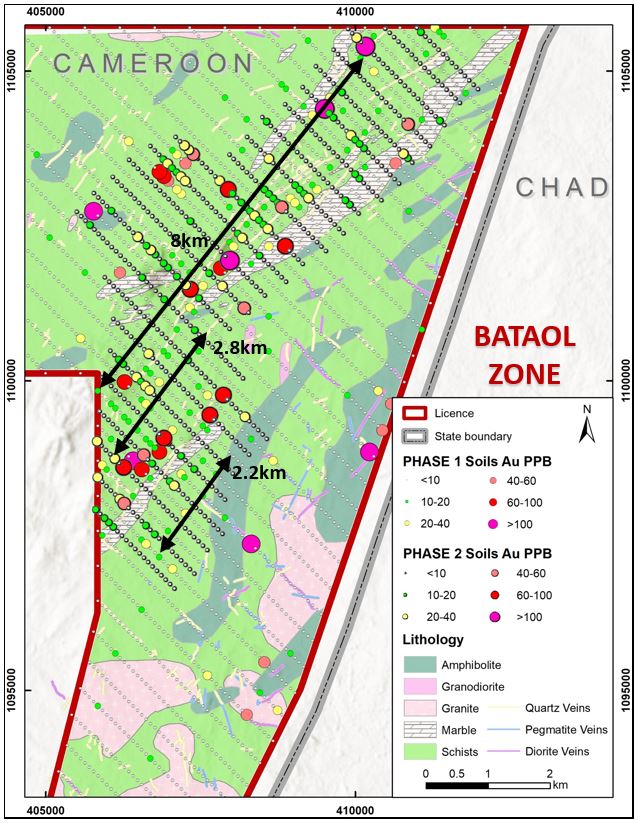

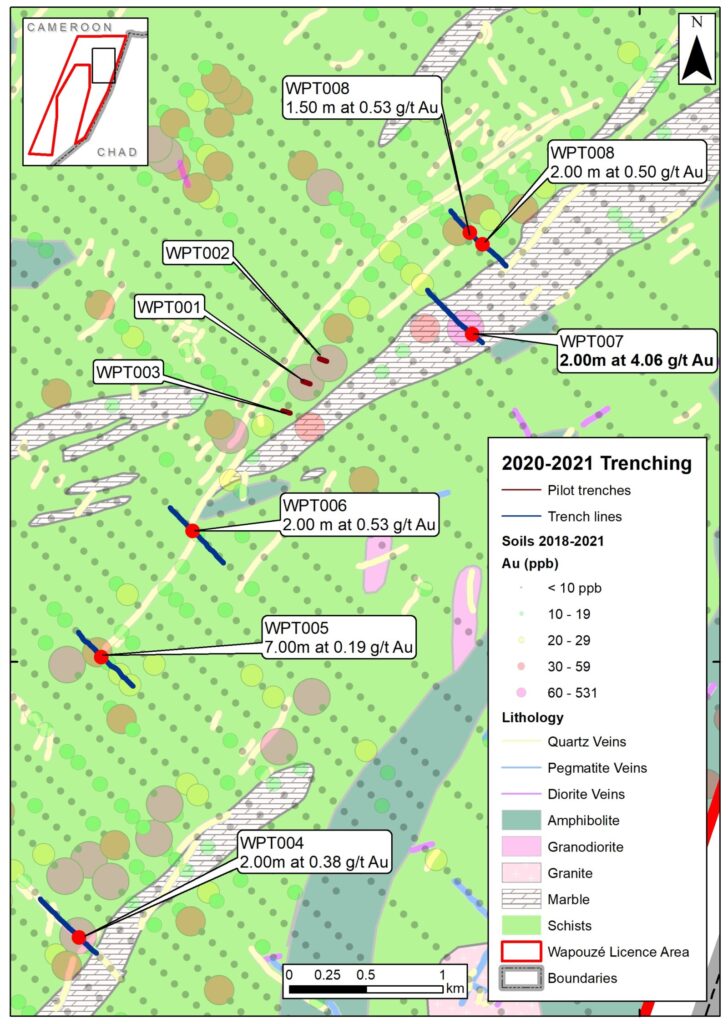

In Q1-2019, Phase 1 systematic soil sampling was completed on a 400m by 100m grid to test the eastern portion of the licence for a total of 2,119 samples. Results, up to 531 ppb Au, identified two main zones of NE-trending mineralisation, associated with quartz veins hosted within a NE-trending package of sheared lithologies (amphibolite, diorite, marble and granodiorite) – the Bataol Zone (8km x 5km) in the north-east of the licence, which covers the previously identified stream sediment anomaly and the Bidzar Zone (2km x 4km) in the south-east of the licence.

At the Bataol Zone, multiple parallel >10 ppb Au anomalies have been defined, including an 8km-long by 0.2km-wide NE-trending anomaly. Multiple further anomalies have been defined in the Bidzar Zone, one of which (0.4km x 0.1km anomaly, >60 ppb Au) is supported by a 7.36 g/t Au selective rock-chip sample from an outcropping quartz vein.

Phase 2 infill soil sampling (200m x 100m grid) was completed over main anomalies at the Bataol Zone in order to identify more discrete zones of higher-grade anomalism. Results for 639 soil samples returned a best grade of 210 ppb Au, with 3 samples reporting greater than 100 ppb Au, 45 samples >20 ppb Au and 123 samples >10 ppb Au. The soil results further confirm continuity of the >10 ppb gold-in-soil anomalies reported for Phase 1 soil sampling and have also defined more robust zones of higher-grade mineralisation within and independent of these zones. Of particular note is a >60 ppb Au anomaly that extends over an area of 1km by 300m within the previously-identified 2.8km anomaly in the centre of the Bataol Zone. This, and other areas of higher-grade gold-in-soil anomalism, appear to be related to nearby northeast-trending silicified and sheared metasedimentary unit.

In Q1-2021, the Company completed a 150m pilot trenching programme for three trenches (WPT001 to WPT003) across a small portion of the 8km-long anomaly. However, the programme did not return any significant intersections and so in Q4-2021, a further five trenches (WPT004 to WPT008) were completed for 2,524m. Four of the trenches were planned to test the anomaly either side of the pilot trenches, at a regional spacing of 500m to 1km, whilst the fifth trench was designed to test the centre of the parallel 2.8km-long anomaly. All trenches were orientated towards 130 degrees. The results reported today have confirmed anomalous gold (using a 0.10 g/t Au cut off) in all trenches, with a best intersection of 2.00m grading 4.06 g/t Au reported in WPT007.

Project ownership

As part of corporate restructuring in 2024, Oriole agreed that it would retain an 85% ownership of the project. The remaining 15% is held by its Local Partners BEIG3 Sarl and Roxane Minerals Limited.

Oriole is a first-mover in Cameroon and is also operating a district-scale ~3,600km2 licence package in Central Cameroon.